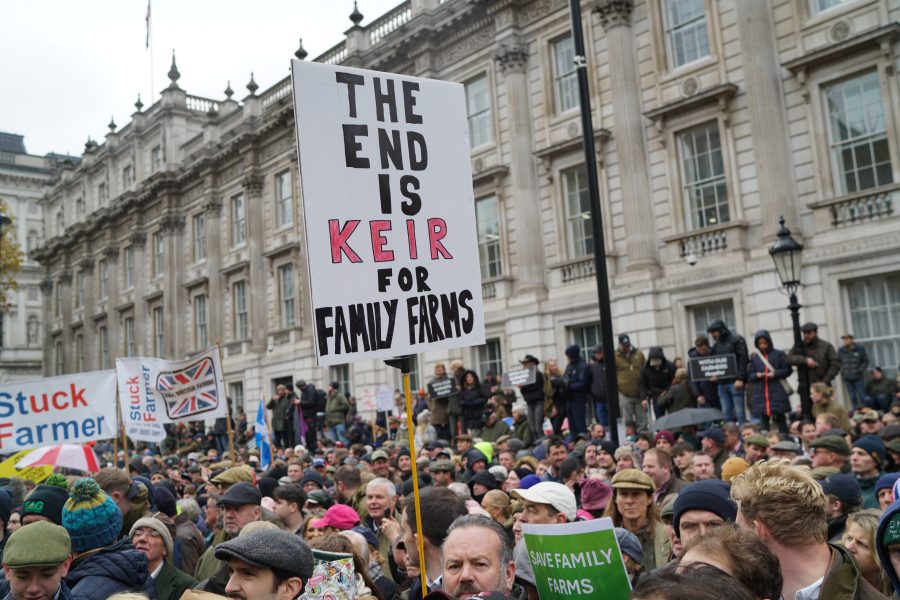

More than 10,000 farmers took to the streets of Westminster to protest at budget tax changes that many believe threaten the future of family farms across the country.

Changes to agricultural property relief and business property relief will potentially see farmers who inherit the family business faced with an inheritance tax bill that could result in them having to sell land to pay for it, something which could in turn destroy the viability of the farm.

With the Metropolitan Police estimating the number of people taking part at more than 10,000, the impressive turnout reflected the strength of feeling across the country at what many see as a betrayal by a party that had earlier said it had no plans to alter inheritance tax.

While farmers, some of whom arrived on tractors, made their presence felt, a further 1,800 members of the NFU attended meetings with their MPs at Church House, in Westminster, and in Parliament. The day represented a mass lobbying event organised by the NFU to highlight to MPs why, in its words, “the changes to APR and BPR must be reversed for the sake of the rural economy, for national food security and to enable farmers to continue to support the environment and protect the countryside”.

NFU president Tom Bradshaw, who also addressed the rally, which was organised independently of the NFU and attended by both members and non-members, told the Church House meeting that he didn’t think he had ever seen the industry “this angry, this disillusioned and this upset”, adding: “And given what we’ve had to be angry about in recent years, that’s saying something.”

He began by telling the audience: “You don’t need me to tell you that farmers and growers put up with a lot, but it takes something extraordinary to get us to react like this – and this betrayal on APR/BPR is extraordinary, and it affects farmers from every corner of Britain.”

Describing the tax changes as a “shocking policy”, he said it was “built on bad data and launched with no consultation”, adding: “The Treasury didn’t even tell DEFRA.”

Tom went on: “To launch a policy this destructive without speaking to anyone involved in farming beggars belief. And let us remember that they promised not to do this when they were wooing the rural vote.

“It’s not only been bungled in delivery, it’s also nothing short of a stab in the back.”

Describing the APR and BPS plans as “the straw which broke the camel’s back for farming”, he commented: “After years of changing policy and 18 months of some of the worst weather on record, the budget has been a kick in the teeth. It is full of let-downs for our vital sector: accelerated BPS reductions, double cab pick-up taxes, new taxes on fertilisers. The list goes on.

“We know what this means for our families, for our children, for our future. We know the horrendous pressure it is putting on older farmers worried sick. It’s wrong on every level and, just as bad, it won’t achieve what ministers want it to anyway.

“Far from catching wealthy homeowners with a bit of land, the Treasury’s mangling of the data means those people will generally not be affected. It’s the farms producing this country’s food, which are more valuable assets, that are caught in the eye of the storm.”

He told those present: “Your key job today is to look your own MPs in the eye and make them understand that there is a political price to be paid, by them, not just ministers, for supporting this rotten policy. In Westminster, in Cardiff, in Edinburgh and in Belfast.

“Our request is simple – this is a policy that will rip the heart of out of Britain’s family farms, launched on bad data with no consultation and it must be halted and considered properly, taking in the views of the experts, not just Treasury civil servants.”

And he concluded: “Today isn’t the culmination of our efforts. It’s the start.”

During the day various Government spokesmen repeated the official line that married farming couples who met all the necessary criteria could claim £3m in inheritance tax relief and continued to suggest that only a limited number of wealthier farmers would be affected.

The industry has also rejected the suggestion that farmers could gift their farm to their children and avoid inheritance tax as long as they lived for seven years, because drawing a pension from the farm or living in one of its properties without paying rent would count as a “reserved benefit” under the rules.

Left to right: NFU members Neil Fuller, Nick Bullen, Nellie Budd, Paula Matthews and Simon Maiklem with NFU Surrey County Adviser Harriet Henrick. Photo: Brian Finnerty/ NFU

For more like this, sign up for the FREE South East Farmer e-newsletter here and receive all the latest farming news, reviews and insight straight to your inbox.